Property Tax Rates For Burleson County Texas . our burleson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the median property tax (also known as real estate tax) in burleson county is $1,050.00 per year, based on a median home value. the certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in. beginning with tax year 2020, the effective rate becomes the no‐new‐revenue rate (nnr) and the rollback rate becomes the. Burleson county is rank 198th out. The following tax rates are per $100 of assessed value. specific duties include collection of current and delinquent taxes, penalties, interest and other fees for the county and other taxing. burleson county (1.06%) has a 35% lower property tax rate than the average of texas (1.63%).

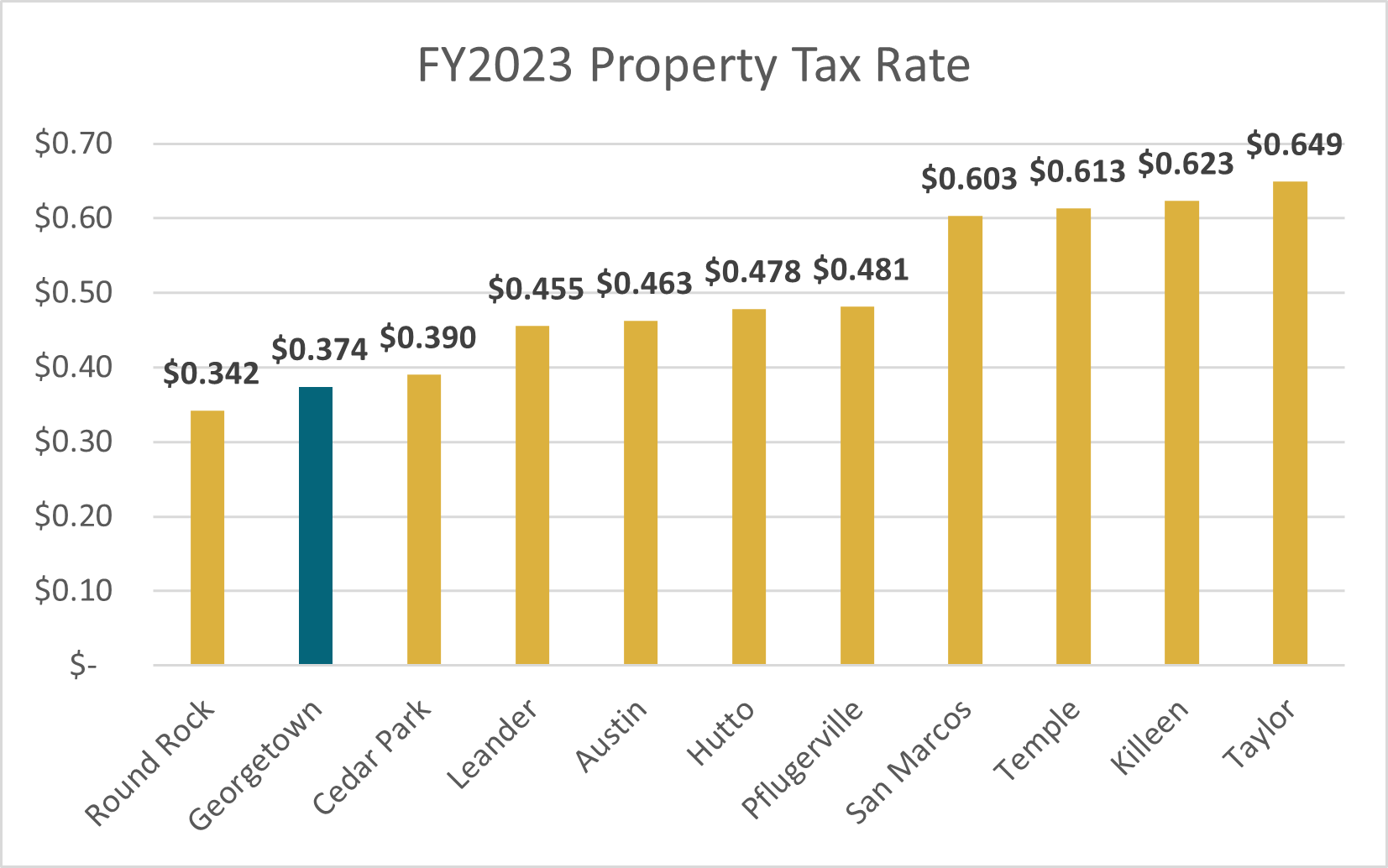

from finance.georgetown.org

beginning with tax year 2020, the effective rate becomes the no‐new‐revenue rate (nnr) and the rollback rate becomes the. burleson county (1.06%) has a 35% lower property tax rate than the average of texas (1.63%). Burleson county is rank 198th out. the median property tax (also known as real estate tax) in burleson county is $1,050.00 per year, based on a median home value. The following tax rates are per $100 of assessed value. the certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in. our burleson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. specific duties include collection of current and delinquent taxes, penalties, interest and other fees for the county and other taxing.

Property Taxes Finance Department

Property Tax Rates For Burleson County Texas Burleson county is rank 198th out. the certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in. burleson county (1.06%) has a 35% lower property tax rate than the average of texas (1.63%). Burleson county is rank 198th out. the median property tax (also known as real estate tax) in burleson county is $1,050.00 per year, based on a median home value. specific duties include collection of current and delinquent taxes, penalties, interest and other fees for the county and other taxing. The following tax rates are per $100 of assessed value. beginning with tax year 2020, the effective rate becomes the no‐new‐revenue rate (nnr) and the rollback rate becomes the. our burleson county property tax calculator can estimate your property taxes based on similar properties, and show you how your.

From nataliewirina.pages.dev

Texas Property Tax Increase 2024 Alicia Meredith Property Tax Rates For Burleson County Texas our burleson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in. the median property tax (also known as real estate tax) in burleson county is $1,050.00. Property Tax Rates For Burleson County Texas.

From knowyourtaxes.org

Burleson County » Know Your Taxes Property Tax Rates For Burleson County Texas specific duties include collection of current and delinquent taxes, penalties, interest and other fees for the county and other taxing. beginning with tax year 2020, the effective rate becomes the no‐new‐revenue rate (nnr) and the rollback rate becomes the. our burleson county property tax calculator can estimate your property taxes based on similar properties, and show you. Property Tax Rates For Burleson County Texas.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rates For Burleson County Texas the median property tax (also known as real estate tax) in burleson county is $1,050.00 per year, based on a median home value. burleson county (1.06%) has a 35% lower property tax rate than the average of texas (1.63%). specific duties include collection of current and delinquent taxes, penalties, interest and other fees for the county and. Property Tax Rates For Burleson County Texas.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rates For Burleson County Texas our burleson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. specific duties include collection of current and delinquent taxes, penalties, interest and other fees for the county and other taxing. The following tax rates are per $100 of assessed value. Burleson county is rank 198th out. the. Property Tax Rates For Burleson County Texas.

From txcip.org

Texas Counties Total Taxable Value for County Property Tax Purposes Property Tax Rates For Burleson County Texas specific duties include collection of current and delinquent taxes, penalties, interest and other fees for the county and other taxing. the median property tax (also known as real estate tax) in burleson county is $1,050.00 per year, based on a median home value. our burleson county property tax calculator can estimate your property taxes based on similar. Property Tax Rates For Burleson County Texas.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rates For Burleson County Texas the certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in. burleson county (1.06%) has a 35% lower property tax rate than the average of texas (1.63%). beginning with tax year 2020, the effective rate becomes the no‐new‐revenue rate (nnr) and the rollback rate becomes the.. Property Tax Rates For Burleson County Texas.

From www.honestaustin.com

What Are the Tax Rates in Texas? Texapedia Property Tax Rates For Burleson County Texas Burleson county is rank 198th out. specific duties include collection of current and delinquent taxes, penalties, interest and other fees for the county and other taxing. burleson county (1.06%) has a 35% lower property tax rate than the average of texas (1.63%). The following tax rates are per $100 of assessed value. the certified tax roll and. Property Tax Rates For Burleson County Texas.

From finance.georgetown.org

Property Taxes Finance Department Property Tax Rates For Burleson County Texas the certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in. the median property tax (also known as real estate tax) in burleson county is $1,050.00 per year, based on a median home value. specific duties include collection of current and delinquent taxes, penalties, interest and. Property Tax Rates For Burleson County Texas.

From www.thewoodlandstownship-tx.gov

The Woodlands Township, TX Taxes Property Tax Rates For Burleson County Texas our burleson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. beginning with tax year 2020, the effective rate becomes the no‐new‐revenue rate (nnr) and the rollback rate becomes the. Burleson county is rank 198th out. the certified tax roll and the tax rates adopted by each taxing. Property Tax Rates For Burleson County Texas.

From www.kbtx.com

Burleson County property taxes can be paid on Thursday without penalty Property Tax Rates For Burleson County Texas beginning with tax year 2020, the effective rate becomes the no‐new‐revenue rate (nnr) and the rollback rate becomes the. specific duties include collection of current and delinquent taxes, penalties, interest and other fees for the county and other taxing. the certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the. Property Tax Rates For Burleson County Texas.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Property Tax Rates For Burleson County Texas beginning with tax year 2020, the effective rate becomes the no‐new‐revenue rate (nnr) and the rollback rate becomes the. our burleson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Burleson county is rank 198th out. the certified tax roll and the tax rates adopted by each taxing. Property Tax Rates For Burleson County Texas.

From texasscorecard.com

Commentary How Property Taxes Work Texas Scorecard Property Tax Rates For Burleson County Texas Burleson county is rank 198th out. beginning with tax year 2020, the effective rate becomes the no‐new‐revenue rate (nnr) and the rollback rate becomes the. the certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in. the median property tax (also known as real estate tax). Property Tax Rates For Burleson County Texas.

From heddieychrista.pages.dev

Texas Tax Brackets 2024 Pen Leanor Property Tax Rates For Burleson County Texas Burleson county is rank 198th out. the certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in. the median property tax (also known as real estate tax) in burleson county is $1,050.00 per year, based on a median home value. our burleson county property tax calculator. Property Tax Rates For Burleson County Texas.

From wallethub.com

Property Taxes by State Property Tax Rates For Burleson County Texas The following tax rates are per $100 of assessed value. Burleson county is rank 198th out. burleson county (1.06%) has a 35% lower property tax rate than the average of texas (1.63%). our burleson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the certified tax roll and. Property Tax Rates For Burleson County Texas.

From printablemapforyou.com

Property Taxes In Texas [Oc][1766X1868] Mapporn Texas Property Map Property Tax Rates For Burleson County Texas the certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in. Burleson county is rank 198th out. the median property tax (also known as real estate tax) in burleson county is $1,050.00 per year, based on a median home value. The following tax rates are per $100. Property Tax Rates For Burleson County Texas.

From www.johnlocke.org

Twentyfour Counties Due for Property Tax Reassessments This Year Property Tax Rates For Burleson County Texas beginning with tax year 2020, the effective rate becomes the no‐new‐revenue rate (nnr) and the rollback rate becomes the. the median property tax (also known as real estate tax) in burleson county is $1,050.00 per year, based on a median home value. burleson county (1.06%) has a 35% lower property tax rate than the average of texas. Property Tax Rates For Burleson County Texas.

From www.attomdata.com

Total Property Taxes Up 4 Percent Across U.S. In 2022 ATTOM Property Tax Rates For Burleson County Texas the median property tax (also known as real estate tax) in burleson county is $1,050.00 per year, based on a median home value. the certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in. specific duties include collection of current and delinquent taxes, penalties, interest and. Property Tax Rates For Burleson County Texas.

From texasscorecard.com

North Texas Counties Plan ProTaxpayer Budgets Texas Scorecard Property Tax Rates For Burleson County Texas the certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in. Burleson county is rank 198th out. our burleson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. burleson county (1.06%) has a 35% lower property tax. Property Tax Rates For Burleson County Texas.